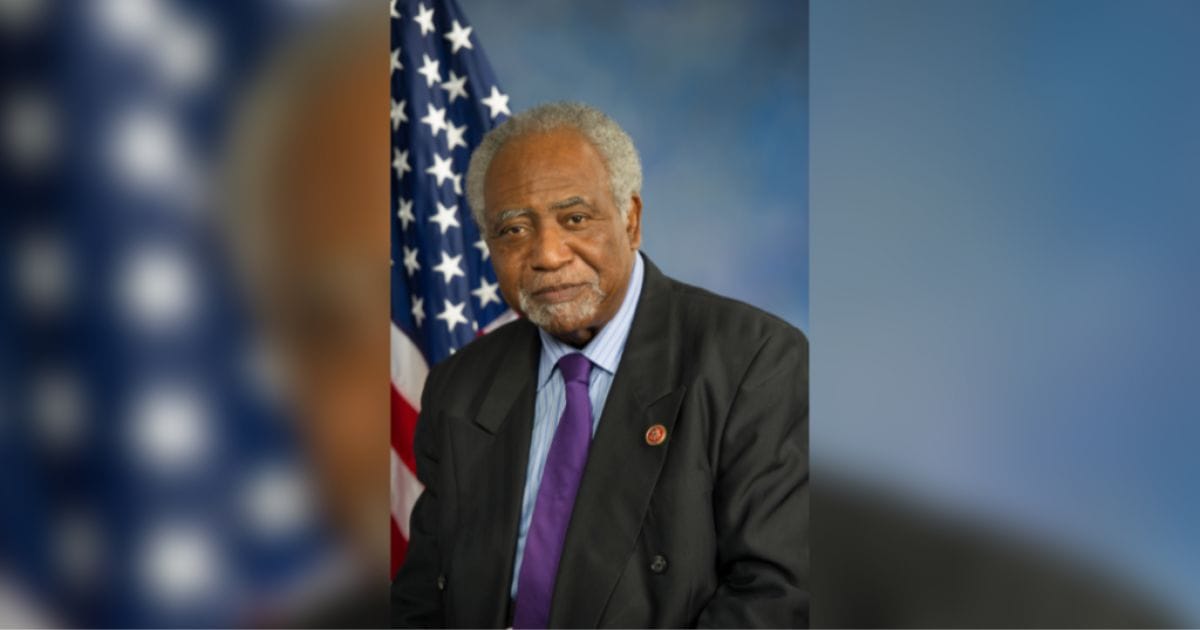

Congressman Danny Davis

With rents continuing to climb “off the charts,” Representative Danny K. Davis (D-7th) and three of his California Democratic peers have introduced a bill that will use tax credits to help people pay their housing costs.

Noting the cost of housing has increased since the pandemic, Davis said the bill will “close the gap between incomes and rising housing costs.”

In an interview with the Chicago Crusader, Davis said he joined with Representatives Jimmy Gomez (D-CA), founder and chair of the first-ever Congressional Renters Caucus, Scott Peters (D-CA), and Jimmy Panetta (D-CA) in introducing the innovative tax credit bill on Tuesday, December 12, that will help millions of renters saddled with soaring rents.

As the gap between incomes and housing costs continues to soar, Davis said, “We are attempting to use tax credits to bridge the gap.” Gomez, Peters and Panetta said rents in California are some of the highest in America.

“If you’re not making big salaries, you struggle to pay rent and live in their Congressional Districts if you don’t own your own home or inherited a piece of property,” said Davis, who like Gomez and Panetta are on the House Ways and Means Committee. For those fortunate enough to buy property, Davis said that too “is off the charts.”

“The idea is to create an opportunity to get tax credits to bridge the gap between that 30 percent and what people still are lacking to pay their rents,” Davis explained.

According to Gomez, who is also a physician, the Rent Relief Act of 2023 creates a new tax credit for renters and would cover a percentage of the difference between 30 percent of their adjusted gross income and the actual cost of rent and utilities, capping the benefit at 100 percent of Small Area Fair Market Rent.

Gomez said the bill makes the credit available to families who earn up to $100,000 to include “cost-burdened renters in high cost-of-living areas. It also delivers help when needed with monthly payments to pay bills when they are due, building on the successful advanced Child Tax Credit that helped tens of millions escape poverty,” said Gomez.

According to the congressmen, nationally eight million of the lowest-income renters spend at least half of their income on rent leaving them little to cover other basic needs like food, clothing and health care.

A recent report released by Harvard University’s Joint Center for Housing Studies raised the alarm that almost 11.2 million older adults were “cost-burdened with this number, projected to jump as the number of households over 80 is expected to double by 2040.”

The study said currently almost one-third of senior households are cost burdened, with half of these seniors paying more than 50 percent of income for housing. Even though the need for assistance is great, the study stated that only 1 in 4 eligible households actually receive any help, and some households spend years on waitlists due to inadequate funding.

According to the congressmen, creating a new renters’ tax credit, along with expanding targeted investments to increase supply, can help end America’s housing crisis.

“Every day thousands of people in Chicago struggle to pay rent,” said Davis. “The Rent Relief Act will help renters in a real, life-changing way so that they can better care for their families without fear of eviction or making the horrible choice between a roof over their heads or medicine and food for children.

“Direct grant assistance and affordable housing are essential but only help a limited number of households,” said Davis. “A renter’s credit could help every eligible taxpayer afford housing and improve their quality of life, working in concert with other supports to help end America’s housing crisis.”

“I commend Senator Raphael Warnock and Representatives Davis, Gomez, Peters, and Panetta for their leadership in introducing this bold, innovative proposal to help millions of the lowest-income renters bridge the widening gap between incomes and housing costs,” said Diane Yentel, president and CEO of the National Low Income Housing Coalition (NLIHC).

“A new tax credit for renters, like the one proposed today, has the power to transform lives, providing America’s extremely low-income households with the breadth of opportunities that come from having a stable, affordable place to call home,” said Yentel.

“As people struggle to recover from the pandemic and the cost of rent continues to rise, we need significant investments to ensure that families and individuals with the lowest incomes can afford and stay in their homes,” stated Foluke Akanni, Housing Policy Organizer at Housing Action Illinois. “More resources will support cost-burdened renters, prevent homelessness, and help stabilize our communities.”

-

Chinta Strausberghttps://chicagocrusader.com/author/chinta-strausberg/

-

Chinta Strausberghttps://chicagocrusader.com/author/chinta-strausberg/

-

Chinta Strausberghttps://chicagocrusader.com/author/chinta-strausberg/

-

Chinta Strausberghttps://chicagocrusader.com/author/chinta-strausberg/