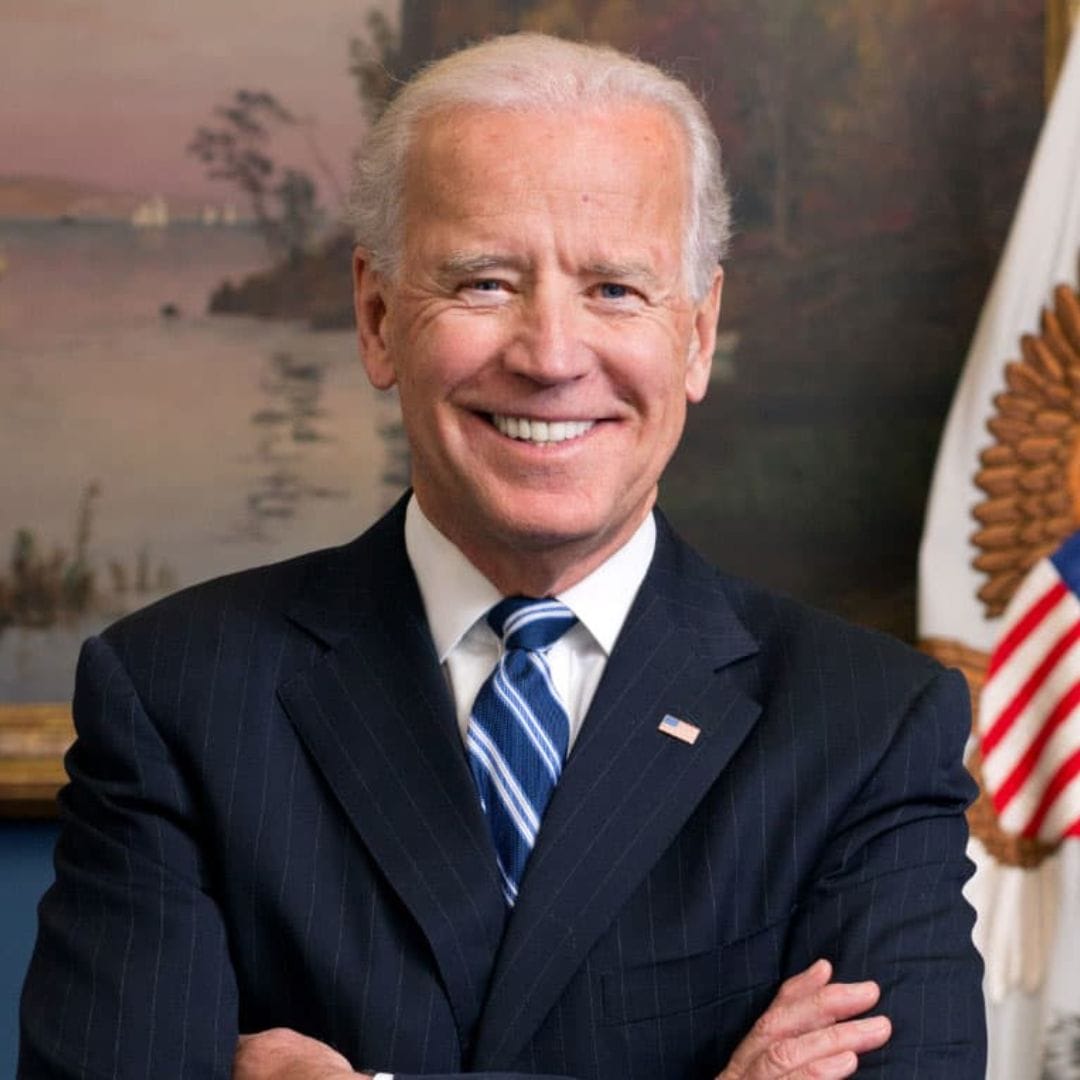

The PUSH Excel Board of Directors congratulates President Biden and the White House’s federal student loan forgiveness plan that will allow federal student loan balances of millions of people to be reduced by up to $20,000.

The PUSH Excel Board of Directors thanks President Biden and the White House for addressing an issue that has been a concern for poor and working families for several decades. The White House acknowledged that since 1980 the total cost of both four-year public and four-year private colleges has tripled.

Pell Grants that once covered nearly 80 percent of the cost of a four-year public college degree now only covers one-third of the total cost.

Furthermore, according to the U.S. Department of Education analysis, the typical undergraduate student with loan notes graduates with nearly $25,000 in debt resulting in a $1.6 trillion debt for more than 45 million borrowers.

America’s student loan debt crisis has been severely impacted by the rise of students enrolling in for-profit colleges, which resulted in one-third of all student loan borrowers having debt but no degree, according to the U.S. Department of Education.

It is against this backdrop of need that President Biden announced a three-part plan to provide some assistance to borrowers especially those coming out of the recent COVID-19 pandemic.

We applaud the President for this initial effort to begin the process of eliminating the student loan debt that is causing many millennials and GEN-Xers to languish in debt with no relief in sight.

Under the President’s moderate plan for relief:

- $10,000 in immediate debt relief for non-Pell Grant recipients and up to $20,000 for Pell Grant recipients for people who earn less than $125,000 or $250,000 for married couples.

- Cutting monthly payments in half for undergraduate loans. The Department of Education is proposing a new income driven repayment plan. We believe this plan begins to address the issues faced by students who have debt but do not have sufficient income to repay their debt and pay rent.

- The plan also addresses the public Service Loan Forgiveness program by offering borrowers who have worked at a non-profit, served in the military or in federal, state, tribal or local governments to receive a credit towards loan forgiveness.

This program requires further analysis and congressional action so that the principles will last beyond one presidential administration. The Biden relief program needs to be instituted in a manner that addresses the systemic parables with funding college education.