If the annual National Urban League report (NUL) measured the effectiveness of white supremacy, disinvestment and financial bias toward African American households, these agencies of destruction would receive an astounding grade. However, the famed NUL “2024 State of Black America” benchmark revealed African Americans have failed to reach racial parity with whites and other groups and continue to face a long road ahead to achieve full equality.

“For Black Americans, the Civil Rights Act of 1964 was the first time that the United States government honored the promises in the Declaration of Independence and addressed the racial caste system that had been protected for centuries by unjust laws and systemic racism,” the National Urban League reported.

“Sixty years later, the fight for equality is far from over,” the Civil Rights organization said, though suggesting that because African Americans have reached 75 percent economic parity with whites, the efforts to obtain the remaining 25 percent has been blocked by Supreme Court decisions, legislative action and a general unwillingness for broader America to embrace diversity, equity and inclusion.

A 75-percent parity rate may sound reassuring to some, but a recent U.S. Census report paints a starker picture.

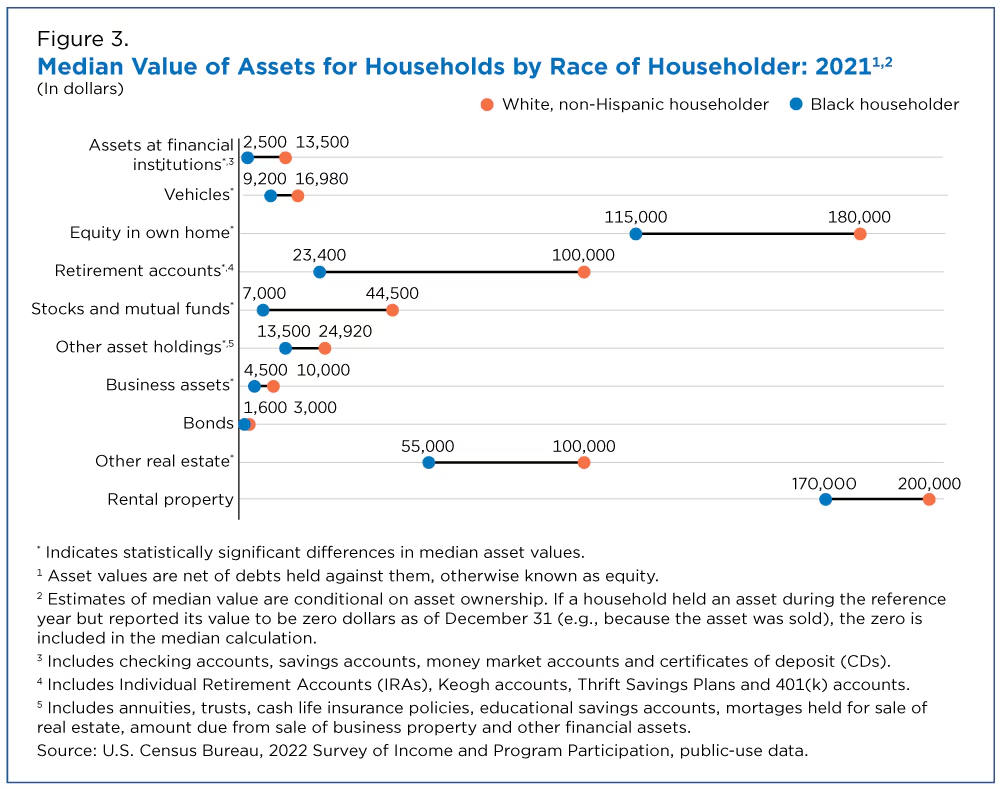

The Bureau recently released data that shows white and non-Hispanic households had 10 times more wealth than Black households. The Survey of Income and Program Participation (SIPP) analyzed figures from 2021 and further revealed that though Caucasians made up 65.3 percent of all households they accounted for 80 percent of all wealth.

The U.S. Census also noted Black households, though 13.6 percent of the U.S. total, held only 4.7 percent of all U.S. wealth. In Chicago, the median household income for whites is $99,363 in contrast to the $61,600 for Hispanics and $40,184 for African Americans–despite the fact that Black people control powerful seats of government, including the mayor, treasurer, county board, attorney general and U.S. Congress, and other positions.

The median wealth for Black people in Chicago is only $24,520 compared to $250,400 for whites. Latino wealth in the city, according to current Census data, is measured at $40,184.

But what about this abundance of Black billionaires profiled in the media, entertainment and by social media influencers? Though, businessmen Robert F. Smith ($6b) and Dave Stewart ($3b); athletes Earvin “Magic” Johnson ($1b), Lebron James ($1b) and Tiger Woods ($1.1b); and, other

celebrities such as Oprah Winfrey ($2.7b) Tyler Perry ($1b), Shawn “Jay-Z” Carter ($1b) are promoted nationally as the standard-bearers of the “American Dream,” the median wealth for African American households overall is $24,520 or one-tenth of the overall median wealth of their Caucasian counterparts at $250,400.

By showcasing on high-profile Black billionaires, there are some people who might be led to believe African American wealth is on the rise. The illusion of billionaire Hip Hop artists who’ve grown wealthy because of their artistic and creative pursuits may be shattered once their liabilities are made known. For example, Chicago-born performer Kanye West was heavily touted as the newest “Black billionaire,” but that claim dissolved after the rapper/producer abruptly ended his branding relationship with a global athletic apparel manufacturer.

According to Forbes magazine, West, “lost his billionaire status” after West was dropped by Adidas, causing his $1.5 billion net worth to plummet to $400 million, despite his 5-percent stake in his ex-wife’s undergarment company.

While some may be tempted to suggest that a lack of ingenuity, a failure to understand the workings of capitalism or a lack of assertive energy may explain why Blacks in the U.S. lag so far behind white people, a simple and honest look at history and the rampant discrimination in banking, finance and real estate will refute this notion.

“If major U.S. companies invest 2 percent of profits in left-behind communities, we can close the racial wealth gap in 10 years,” Smith tweeted in 2020 when he launched his “2% Solution initiative.” The economic justice program calls on “large corporations to use 2 (percent) of their annual net income for the next decade to empower minority communities, including capitalizing financial institutions that service Black-owned businesses” throughout the United States.

Through his foundation, Smith also created a program the Southern Communities Initiative to “accelerate racial equity funding, programming, and outcomes” for African Americans in Atlanta, Birmingham, Alabama, Charlotte, North Carolina, Houston, Memphis and New Orleans. This program focuses on investing in Black-owned businesses, access to capital, educational and workforce development opportunities and digital access to drive differential impact. Since its start in 2021, the initiative has raised more than $100 billion since its launch.

Smith, a Denver native, grew up in a home where both parents held PhDs in education. He is a Cornell University and Columbia Business School graduate. With a background in chemical engineering, finance and business, he earned his wealth as an investment banker as chairman and chief executive officer of Vista Equity Partners. In 2019, the billionaire gained notoriety when during

a commencement speech at Morehouse College, he pledged to pay off the entire $34 million student loan debt of the graduating class.

However, soon after the Morehouse pledge, Smith was targeted by the Internal Revenue Service (IRS) and accused of hiding more than $200 million in income. In 2020 federal prosecutors threatened to indict the billionaire and advocate for significant prison time. But the richest Black person in the U.S. reached a non-prosecution agreement that required him to admit he had committed a crime and agree to pay $139 million in restitution.

CLOSING THE WEALTH GAP

Wealth inequality, also dubbed “the wealth gap,” is the result of numerous anti-Black economic, legislative and sociopolitical policies, rooted in historical racism. Though chattel slavery was banned in 1865 and the proceeding discriminatory practices against Blacks were rectified between 1955 to 1968, African Americans continue to face racial bias in most economic and social sectors leading to income inequality.

Wealth can be calculated by subtracting an individual’s liabilities (mortgages, auto loans, student loans, credit card debt, various bills, etc.) from their assets (cash, investments, retirement accounts, individual property, business investments, etc.). A person’s net worth is simply the value of what a person owns minus the value of what a person owes. If an individual’s assets exceed their liabilities, they have a positive net worth and vice versa.

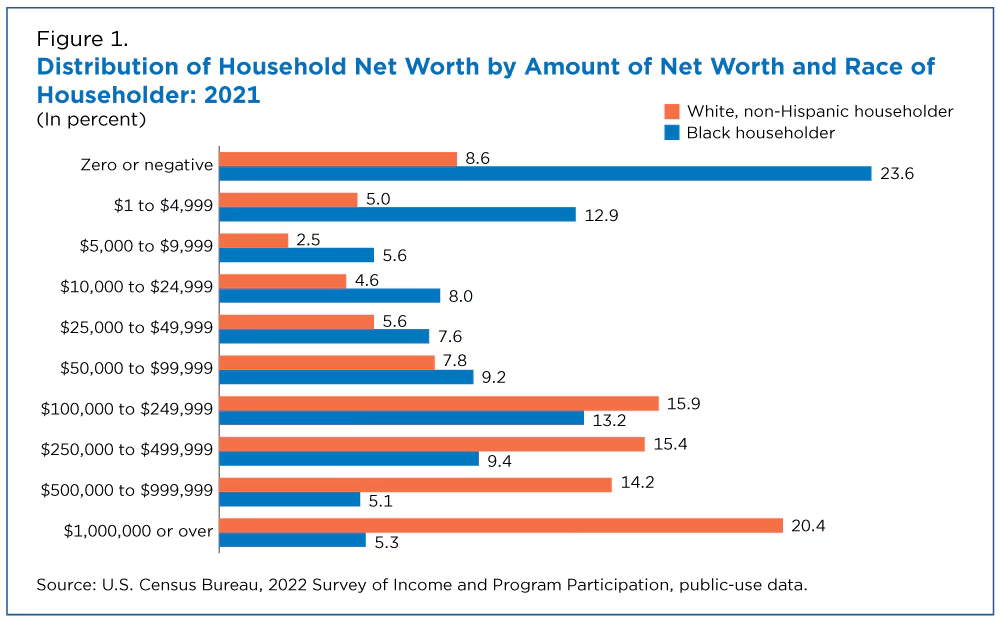

U.S. Census Bureau researchers said, “About 1-in-5 households with a white householder and 1-in-20 households with a Black householder had wealth over $1 million. Just under 1-in-4 households with a Black householder and 1-in-12 households with a white householder had zero or negative wealth. “Households with negative wealth do not have a direct safety net to draw upon in times of need; they are more likely than other households to experience higher rates of financial insecurity and are vulnerable to economic shocks,” wrote researchers Briana Sullivan, Donald Hays and Neil Bennett.

When people earn less, they are unable to save more. And, without access to capital, economic investments, home or business equity or excellent credit scores, few African Americans are able to close the divide.

There is far too much research, historical data and anecdotal evidence to cite them all, but few researchers, economists, sociologists or Civil Rights leaders have disagreed that structural racism is the primary shovel used to create the wealth gap. On top of that legislators and advocates have faced strong opposition in securing reparations for African Americans as restitution for more than 233 years of forced labor, followed by another 150 years of racial violence, and ongoing discrimination, macro/micro aggressions, and economic trickery committed against the descendants of enslaved people. The Chicago Crusader reported last year that by conservative estimates, a federal reparations package would start at $14 trillion-to-$16.8 trillion. Professor William Darity proposed the Federal Treasury offer $350,000 per eligible individual. In 2021 Congress agreed to examine the issue, and on May 18, 2023, Rep. Cori Bush, introduced HR 414 “Reparations Now” outlining various, possible forms of federal reparations payments. There has been no further significant issue on the issue.

Nationwide, civil rights and social justice advocates are calling for rampant investment in Black neighborhoods. Chicago’s predominantly Black neighborhoods have been cited by researchers as either suffering from “hyper-ghettoization” or “hyper-gentrification,” while others believe they are trenches full of generational poverty. In a groundbreaking, televised investigative report, local NBC reporter Marion Brooks said, “Disinvestment in city neighborhoods ultimately leads to poverty, which studies show is often the root cause of violence.”

Despite the bleak outlook, local community-based organizations, faith-based institutions Black-owned financial institutions, government initiatives and minority-business incubators continue to fight to provide a new generation of African American wealth builders. The Far South Side Community Development Corporation launched its Far South CDC Marketplace program to aid residents and businesses with strengthening their delivery of goods and services.

Their marketplace, which features Black-owned businesses, products and other vendors, located at 837 W, 115th St., is open 12 p.m. to 6 p.m. until January 31, 2025. “We are thrilled to continue our Far South CDC Marketplace program, providing an opportunity for these incredible South Side businesses in the city of Chicago to explore the market of a physical retail space and showcase their goods, services and products—as we promote, foster and support entrepreneurship within our communities and obtaining ownership to create generational wealth,” says program director Cam Brown.

Chicago TREND, a Black-owned commercial real estate investment company, launched a crowdfunding campaign that educates and provides funding for Chicago residents and small investors to become co-owners of Roseland Medical and Retail Center, 100-134 W. 111th St. ““We’ve created an investment structure that allows a diverse group of individuals, with as little as $1,000, to co-own (the shopping center) with us,” says Lyneir Richardson, chief executive of the organization. “We believe that by including more people in commercial property ownership, we’ll strengthen the Roseland community and close the racial wealth gap.”

Churches, such as Trinity United Church of Christ, 400 W. 95th St., under the leadership of Rev. Dr. Otis Moss III, offers classes in financial literacy, business development and other economic solutions to aid individuals in improving their financial outcome. Their upcoming literacy class is May 23 at 9:30 a.m. and can be accessed online.

The Business Leadership Council, whose members include Ariel Capital Management founder John Rogers, WVON radio CEO Melody Spann Cooper and others, was created to boost African American wealth in the city. It offers networking opportunities and other wealth development strategies. On the tech front, the Chicago nonprofit P33, in partnership with a global telecommunications company, launched the TechRise initiative to support early-stage Black and Latino tech startups.

The local branch of the Urban League continues to aid Black entrepreneurs in launching, growing and sustaining businesses. And, in terms of government participation, Black -owned businesses rely on the Chicago Minority Supplier Development Council, which helps Minority-owned Business Enterprises (MBEs) on how to meet the criteria for MBE certification, which is needed for giving bids on city, county, state and federal contracting opportunities.

(This report was made possible by the Inland Foundation and the Crusader Newspaper Group).