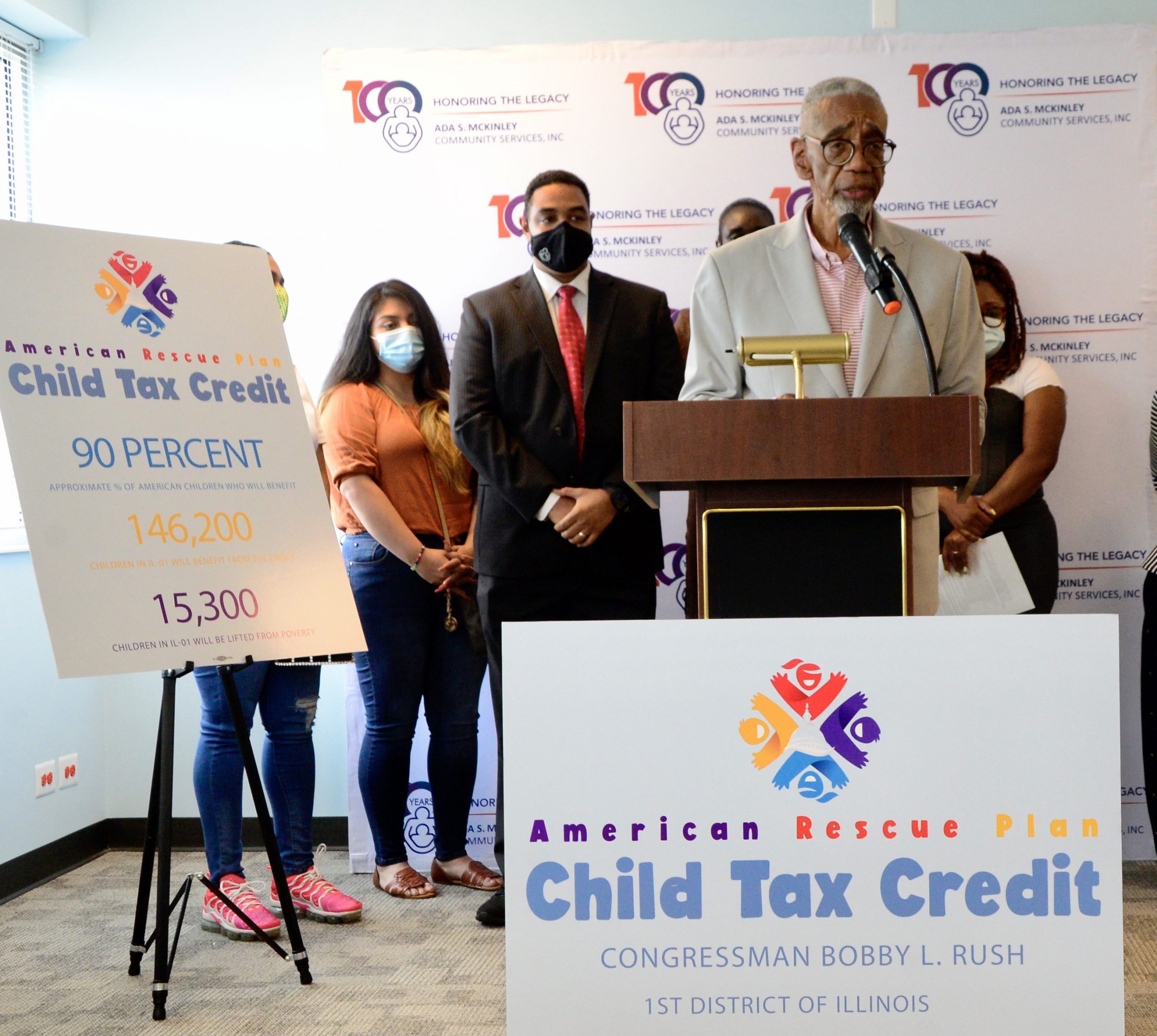

On July 21, 2021, U.S. Representative Bobby L. Rush (D-Ill.) joined families and representatives from Ada S. McKinley Community Services for a press conference highlighting the impact of the expanded monthly Child Tax Credit (CTC) payments in the 1st District and throughout the nation. In addition to Rep. Rush, the press conference featured remarks from Jamal Malone, CEO of Ada S. McKinley Community Services, and mothers with children enrolled in Ada S. McKinley programs who will benefit from the expanded monthly Child Tax Credit payments.

“Despite being the richest country in the world, the reality that we have to face every day is that one in seven American children live in a state of poverty. This is totally unacceptable,” said Rush.

“The Child Tax Credit is the biggest, greatest, and latest anti-poverty program that this nation has undertaken in the last 50 years. It is expected to cut child poverty by half this very year. And as a result, it is going to increase social mobility for these same children and their families for many years to come… We’ve faced this issue head-on, and we are answering the call, providing solutions to this pandemic of poverty among our nation’s children,” said Rush, also noting that the Child Tax credit comes in addition to, and will not affect, SNAP benefits, TANF Cash Assistance, SSI, or other public benefits.

“We made history with the passage of this Child Tax Credit. We are living in a historic time. But in order for us to really make history, we’ve got to make this tax credit permanent. We cannot as a nation allow anyone who comes up out of poverty to fall back into poverty after a year. So we’ve still got a lot of work to do,” said Rush.

Rush concluded by saying that voting for the Child Tax Credit as part of the American Rescue Plan “was one of the proudest votes that I have taken since I’ve been in Congress. And the only thing that will exceed the pride that I felt for helping vote to make the Child Tax Credit a reality is the vote that I will cast to make it permanent.”

Mykela Collins, a mother whose child is enrolled in Ada S. McKinley’s Head Start program, said: “With me being diagnosed with a health issue, I can no longer work. So, [the Child Tax Credit] will actually help me take care of my kids the way that I need to and get extra things for them as far as school supplies, shoes, whatever care they may need. I appreciate the fact that it was a bill that was pushed by our new President and our Congressman, because a lot of our families have been very, very impacted by the pandemic… And hopefully the Child Tax Credit can help some of these families get back to a regular life as far as being able to provide for these families.”

Lana Waters, an employee and parent at Ada S. McKinley, said that she will be saving the Child Tax Credit for school supplies and school uniforms among other things, noting: “I will have extra money thanks to you guys and the Child Tax Credit!”

Overall, 88 percent of American children are estimated to benefit from the newly expanded Child Tax Credit from the American Rescue Plan, including 146,200 children in 43,300 households in Illinois’s 1st District. In the 1st District alone, the Child Tax Credit will lift more than 15,300 children out of poverty, including 5,700 kids under the age of six.

The American Rescue Plan expanded the Child Tax Credit to up to $3,600 per child for children ages 0 to 5 and $3,000 per child for children ages 6 to 17 and authorized advance monthly payments of the Child Tax Credit through December 2021. From July through December of this year, qualifying families can get up to $300 a month per child for children ages 0 to 5 and $250 a month per child for children ages 6 to 17. Families will get their remaining expanded Child Tax Credit when they file their 2021 tax return.

Most families should receive the payments — which started on July 15th — automatically through direct deposit or in the mail. Families who did not file a tax return for 2019 or 2020 and who did not use the IRS Non-filers tool last year to sign up for the Economic Impact Payments, should use the IRS Child Tax Credit Non-filer Sign-up Tool to sign up. More information is available at ChildTaxCredit.gov; Rush also encouraged constituents to reach out to his office if they needed assistance with their payments.

Families will qualify for the full Child Tax Credit if their income is below $75,000 for single filers, $112,000 for people filing as head of household, or $150,000 for people who are married and filing jointly.