A study by the Cook County Treasurer’s Office finds that government-sanctioned, racist housing policies dating back 80 years continue to harm lower-income, mostly minority communities throughout the county.

The bulk of distressed properties in Chicago and its suburbs fall into areas redlined by the U.S. government in 1940, or in areas where Black people moved to escape urban blight, Cook County Treasurer Maria Pappas said.

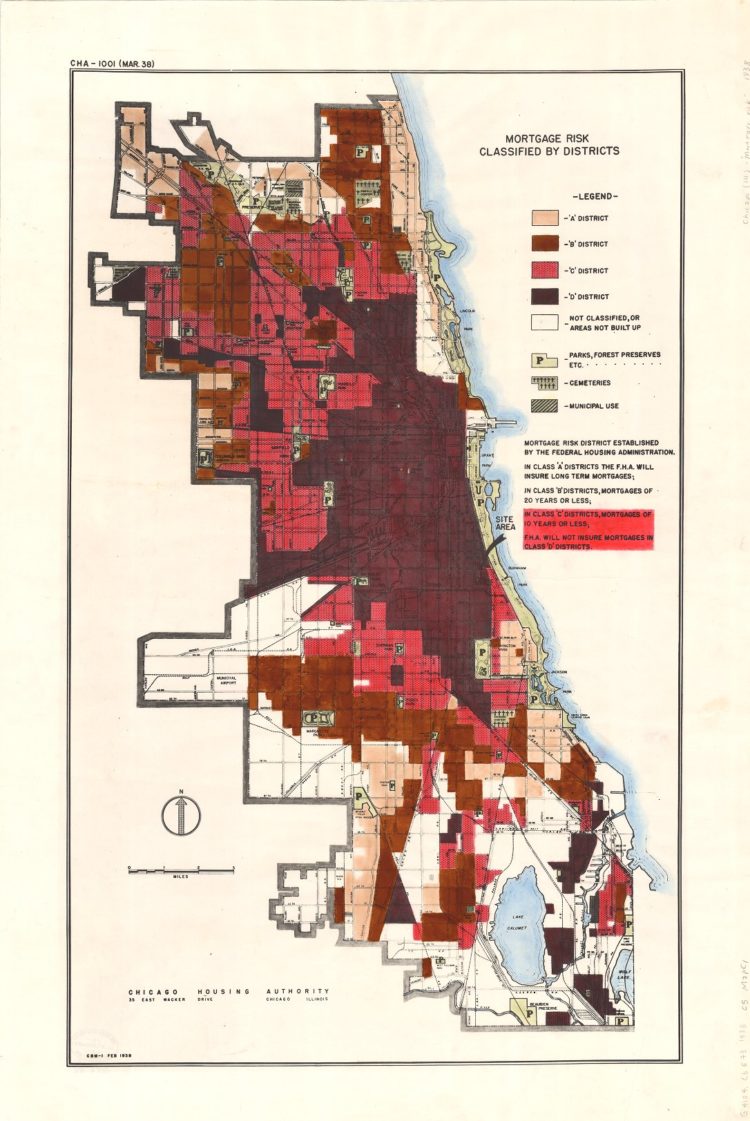

Redlining is the practice of denying loans to homebuyers in minority areas by deeming them a financial risk. The term referred to the red shading on maps of urban areas where the federal government, working with lenders, discouraged issuing mortgages.

“Redlining may be illegal now, but housing discrimination still exists,” Pappas said. “Today’s problem of abandoned properties and boarded-up businesses is a blister that’s been festering for 80 years and needs a lancing. This study is meant to be the needle.”

Other findings of the study:

- Homes in redlined areas were nearly three times more likely to be seriously delinquent in property tax payments.

- These neighborhoods continue to suffer from high crime rates and population loss.

- Similar discriminatory patterns occurred in Detroit and Philadelphia, cities that also struggle with urban decay and the departure of Black residents.

- The Scavenger Sale – a decades-old auction system meant to restore properties to productive use – is incapable of filling its mission.

- Latino communities have also been impacted by redlining. More than 6,000 mostly vacant and abandoned properties offered at the 2022 Scavenger Sale are in often-redlined areas with significant Latino populations. The 16th ward on Chicago’s South Side had the highest percentage of vacant and abandoned properties offered at the 2022 Scavenger Sale. Much of that ward had been redlined and 48% of its residents identify as Latino.

The Treasurer’s recommendations to return deteriorating properties to productive use include creating a public database of abandoned properties; replacing the Scavenger Sale with a program allowing developers and local governments to receive properties free of financial encumbrances and rehab them more quickly; and advancing legislation to lower the interest rate applied by the county to delinquent property tax payments from 18% per year to 9% per year, lessening the burden on homeowners trying to repay their delinquent taxes to save their homes.