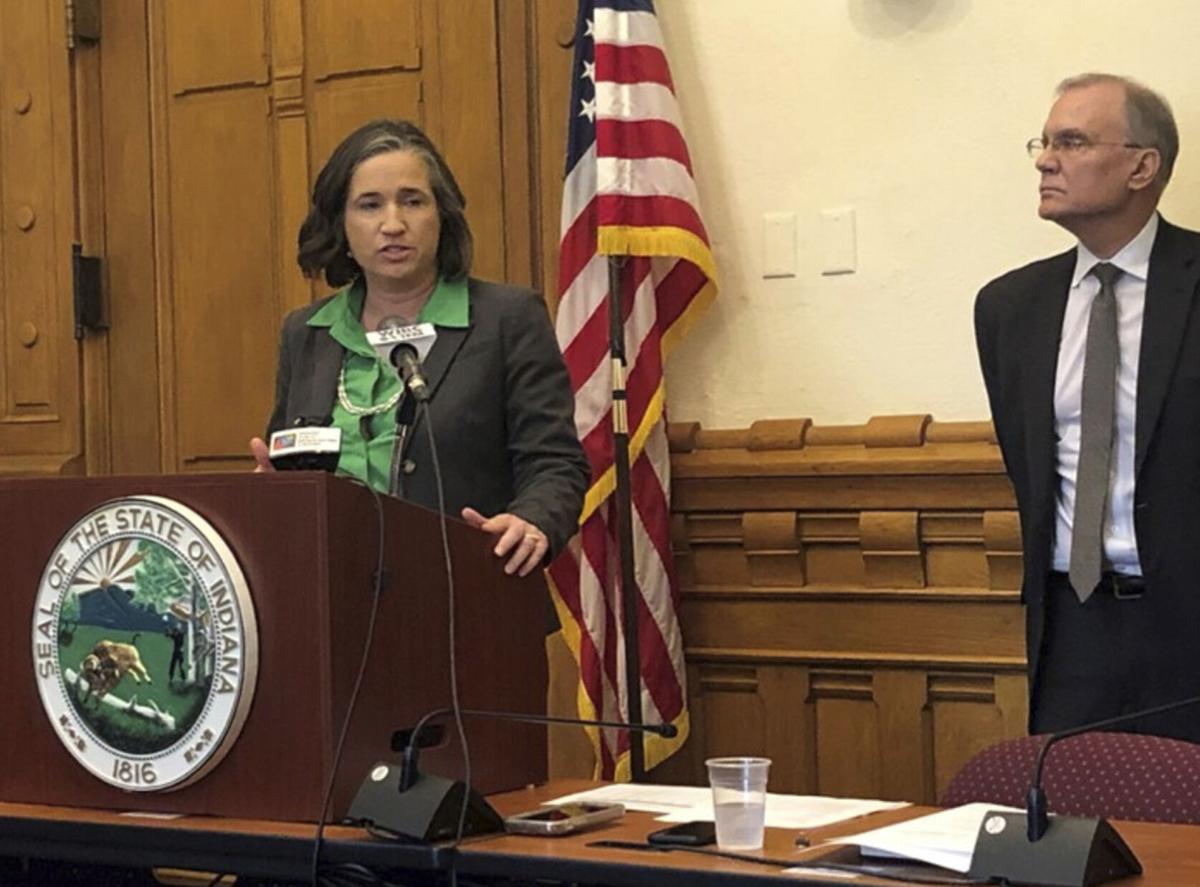

State Auditor Tera Klutz, CPA has announced that Indiana closed the 2021 fiscal year with reserves of $3.9 billion.

“Indiana once again exceeded expectations and soared through the recession with one of the fastest recoveries on record to end with a cash reserve of $3.9 billion at the end of June,” said Auditor Klutz. “Indiana is poised to make an excess reserve transfer of $1.1 billion, which will be split between retirement funding and a refundable income tax credit for Hoosier taxpayers.”

The annual report, prepared by the State Budget Agency, highlights the state’s fiscal year ending on June 30, 2021.

“Because of the strong position Indiana occupied going into last year’s unprecedented global pandemic and partnerships at all levels of government, we now find ourselves at a place of full employment and growing economy. State fiscal leaders deserve high praise for closely monitoring financial forecasts and then quickly adapting to the facts on Main Street, Indiana.

We quickly pivoted from managing through a once anticipated recession due to the ramifications of the COVID-19 pandemic to closing the state fiscal year with $3.9 billion in combined reserves. Now, with our 19th straight balanced budget, we are working on everything from mental health programs and health care supports to record increases in K-12 tuition support. We’re investing in state public facilities and infrastructure projects statewide on a level never seen before all the while doing everything we can to create a highly skilled workforce to fill the open jobs of today and tomorrow.

Auditor Klutz credits strong fiscal leadership and teamwork for how Indiana was able to financially navigate through the national pandemic and economic uncertainty while ensuring a reasonable state reserve.

“Indiana’s economic future and fiscal responsibility are directly linked. Maintaining sustainable finances creates a better, stronger, more prosperous Hoosier state for the next generation,” added Auditor Klutz.

Cris Johnston, Office of Management and Budget Director, echoed Auditor Klutz’s statements and added “Years of fiscal discipline, sound tax policy, a resilient Indiana economy, and federal pandemic financial assistance are all reflected in these impressive year-end results which have presented the opportunity to make strategic investments which will benefit Hoosiers in the years to come.”

“The official revenue forecast on April 15th added $463 million to our projections for FY 2021,” said Zac Jackson, State Budget Director. “In the last 75 days of the fiscal year, we exceeded those projections by an additional $1.222 billion. It’s unprecedented for the General Fund reserve balances to increase by nearly $1.7 billion in less than three months.”

“Indiana continues to be a leader in fiscal responsibility and, with the recent upgrades to the Indiana Transparency Portal, a leader in financial transparency as well,” noted Auditor Klutz. In May, the Auditor updated the Indiana Transparency Portal with local government distribution data as part of the in-depth reports on the state’s revenues and expenditures.

State Senator Eddie Melton was also excited to share the news to Hoosiers who should soon see a tax refun due to the surplus.

“Our statute requires an automatic tax payer refund when revenues exceed a certain limit,” Melton explained. “Since we exceeded that amount, eligible tax filers in Indiana can expect a tax refund in 2022. The last time revenue amounts triggered a refund was in 2012. The payments were $111 to single filers and $122 to joint filers. The amount eligible Hoosiers will receive next year will depend on the number of tax returns filed.”

The news was not all good coming from Melton’s office though, the senator did call on Holcomb to stay in line with neighboring states and continue unemployment benefits for hoosiers that haave fallen on hard economic times since the beginning of the COVID-19 pandemic.

“I also urge the governor to follow the lead of Illinois, Michigan, Kentucky and Ohio who are all waiving the payback of Unemployment Insurance benefits distributed to recipients in error. Hoosiers shouldn’t have to worry about paying back funds they received through no fault of their own and which they have likely already spent to keep their mortgage paid and lights on,” Melton said. “The COVID-19 pandemic put our families through many economic struggles, and we should use this money to continue uplifting Hoosiers in a way that helps them get back to work, care for their families and catch up on bills.”