Crusader Staff Report

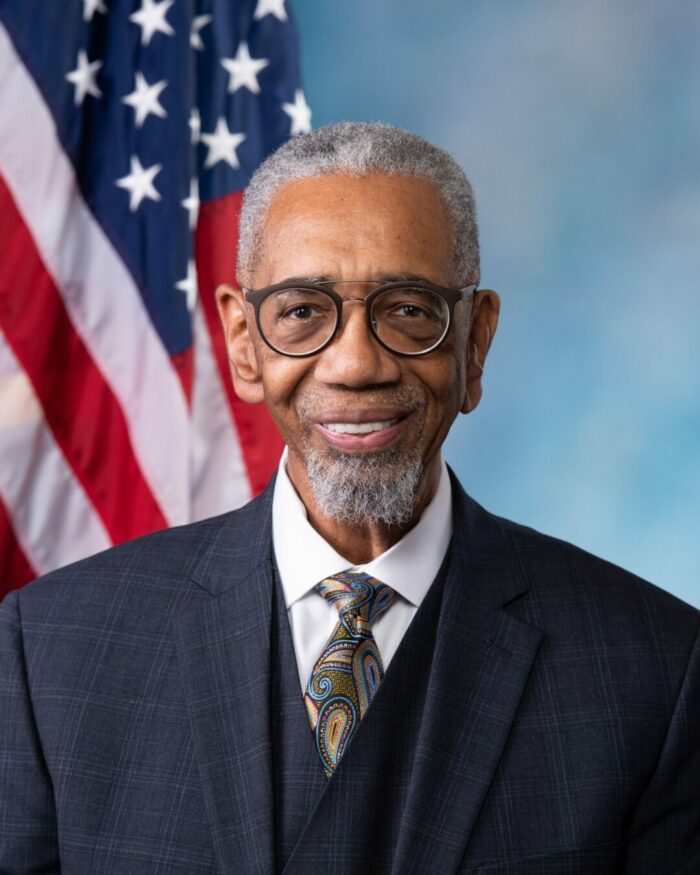

Congressman Bobby Rush (D-Illinois) is calling for a study to examine alleged disparities in home appraisal values between white- and Black-owned homes across the country.

The request comes amid news reports of Black homeowners using white friends and colleagues as decoys to get a second appraisal of their properties after receiving an original appraisal that seemed much lower than what their homes are worth.

In a letter this week to U.S. Government Accountability Office (GAO) Comptroller General Gene L. Dodaro, Rush said, “Discrimination in home appraisals has resulted in a systemic robbery of wealth from Black families and Black communities, a robbery as insidious as redlining and Jim Crow.

“The stunning disparities in appraisal rates between Black- and white-owned homes underscore a fundamental truth: that it is costly to be Black in America. It is time to use the imprimatur of the U.S. Congress to shine a bright light on this issue in order to officially determine the scope of the problem, identify solutions, and make the issue known far outside of Black and brown communities,” he said.

Rush remarked that research has repeatedly indicated that homes in Black and brown neighborhoods are appraised at lower values than those in white neighborhoods, regardless of the attributes of the actual home. He said in many places, the racial composition of a neighborhood is the primary determinant of a home’s appraisal value — even more important than factors such as location, age of the home, and square footage.

Rush said racial inequality in housing appraisals is widening — the value of homes in white neighborhoods rose an average of $225,000 in real dollars from 1980 through 2015, while houses in communities of color saw their value rise by only an average of $31,000 in that same period.

In Chicago, Rush said the disparity between appraisal values in Black and Latino neighborhoods as opposed to white neighborhoods has increased more than six-fold since 1980. Citing recent data from the Appraisal Institute, Rush said the appraisal profession is approximately 85 percent white, and less than two percent of appraisers identify as Black.

“To truly achieve racial equity in the housing market, we must examine every possible way to eliminate the discriminatory vestiges of its foundation. Given that homeownership remains one of the primary ways for American families to build wealth, it is vital to ensure that minority homeowners do not continue to receive discriminatory treatment that systematically devalues their homes. That is why it is imperative that the GAO promptly undertake a comprehensive study detailing why such extreme racial disparities exist within home appraisals and how to rectify them,” Rush wrote in the letter.

According to a story in the New York Times, in 2020, Abena and Alex Horton, an interracial couple in Jacksonville, Florida, had their four-bedroom, four-bath ranch style-home appraised for $330,000. They expected an appraisal of $450,000 in the predominately white neighborhood. Abena Horton, who is Black, suspected discrimination and had a second appraisal done. This time she removed all family photos of Black relatives and books by Black authors from the shelves. She left photos of her white husband and his relatives on display in the home. Abena and her 6-year-old son went on a shopping trip on the day of the second appraisal. This time, the home was valued at $465,000 — a more than 40 percent increase from the first appraisal.

The same thing happened to Carlette Duffy, a Black homeowner in Indianapolis, who received an appraisal that valued her home at $125,000 in a hot neighborhood, according to National Public Radio. She got a second appraisal that said her home was valued at just $110,000. On the third appraisal, Duff left her race and gender off the application. One of her friend’s husbands, who is white, agreed to stand in during the third appraisal. Duffy reportedly took out everything that might indicate her race and left her home. This time, her home was valued at $259,000.

Rush said a 2018 study from the Brookings Institute found that in the average U.S. metropolitan area, homes in neighborhoods where the share of the population is 50 percent Black are valued at roughly half the price as homes in neighborhoods with no Black residents. The difference in appraisals has led to a $156 billion cumulative loss in value nationwide for majority-Black neighborhoods. In the Chicago-Naperville-Elgin area, homes in majority-Black neighborhoods are devalued by an average of 28 percent.

Rush is also a co-sponsor of the Real Estate Valuation Fairness and Improvement Act (H.R. 2553), which would establish a task force to identify and remove barriers to equitable real estate valuation and provide federal grant funding to facilitate diversity in the appraisal profession.

Thanks to the generosity of funding provided by The Field Foundation of Illinois, Inc. in producing this article.